All Categories

Featured

Table of Contents

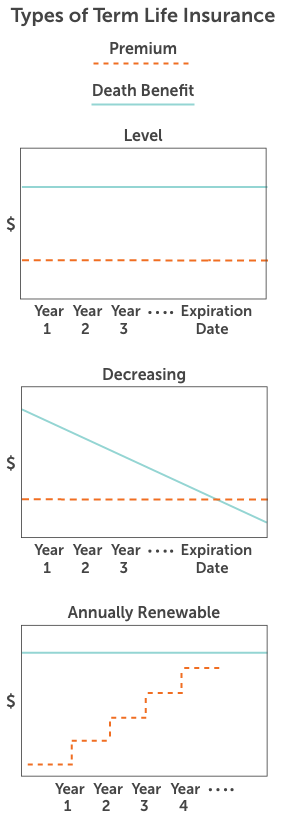

That typically makes them a much more cost effective choice permanently insurance coverage. Some term plans might not keep the costs and survivor benefit the same in time. You don't want to incorrectly believe you're acquiring level term coverage and after that have your survivor benefit modification in the future. Lots of people get life insurance policy protection to assist economically protect their enjoyed ones in situation of their unanticipated fatality.

Or you might have the option to transform your existing term protection right into a permanent plan that lasts the rest of your life. Various life insurance policy policies have potential benefits and disadvantages, so it's essential to recognize each before you make a decision to buy a plan.

As long as you pay the costs, your recipients will certainly obtain the death benefit if you pass away while covered. That said, it's crucial to keep in mind that many policies are contestable for 2 years which indicates coverage might be rescinded on fatality, ought to a misstatement be found in the app. Plans that are not contestable frequently have actually a graded death advantage.

Costs are usually lower than whole life policies. You're not locked right into a contract for the rest of your life.

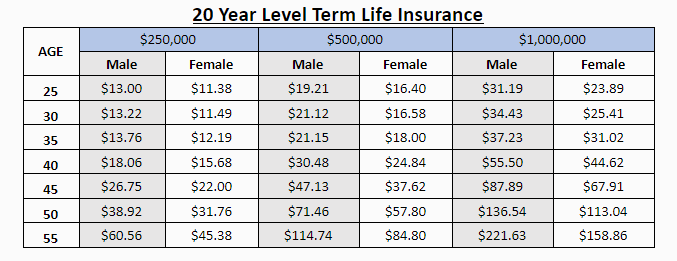

And you can not pay out your policy during its term, so you won't receive any monetary gain from your previous insurance coverage. Similar to other kinds of life insurance, the expense of a degree term policy depends upon your age, insurance coverage needs, work, lifestyle and wellness. Typically, you'll locate a lot more budget friendly protection if you're younger, healthier and much less high-risk to guarantee.

Preferred A Renewable Term Life Insurance Policy Can Be Renewed

Given that degree term costs stay the same for the period of protection, you'll understand precisely how much you'll pay each time. Degree term coverage also has some adaptability, allowing you to customize your plan with additional functions.

You may need to satisfy certain problems and qualifications for your insurance provider to enact this biker. Additionally, there may be a waiting period of up to 6 months prior to taking effect. There likewise might be an age or time limitation on the coverage. You can include a kid motorcyclist to your life insurance policy plan so it also covers your youngsters.

The survivor benefit is typically smaller sized, and coverage typically lasts up until your kid turns 18 or 25. This motorcyclist might be a much more economical way to aid guarantee your kids are covered as riders can usually cover several dependents simultaneously. As soon as your youngster ages out of this coverage, it may be feasible to transform the biker into a brand-new plan.

The most typical type of irreversible life insurance policy is whole life insurance coverage, but it has some crucial distinctions contrasted to level term protection. Right here's a standard review of what to consider when contrasting term vs.

Direct Term Life Insurance Meaning

Whole life entire lasts for life, while term coverage lasts for a specific periodCertain The costs for term life insurance coverage are commonly lower than entire life coverage.

One of the major features of level term coverage is that your premiums and your fatality advantage do not transform. You might have protection that starts with a death advantage of $10,000, which can cover a home mortgage, and then each year, the death advantage will certainly lower by a collection amount or percentage.

Because of this, it's often a much more budget-friendly sort of level term coverage. You might have life insurance policy with your employer, but it may not be sufficient life insurance coverage for your requirements. The primary step when purchasing a plan is figuring out just how much life insurance policy you need. Consider aspects such as: Age Family members dimension and ages Employment standing Revenue Debt Way of life Expected last expenditures A life insurance coverage calculator can assist figure out just how much you require to start.

After determining on a policy, finish the application. For the underwriting procedure, you might need to provide general personal, health and wellness, way of living and employment details. Your insurance company will certainly establish if you are insurable and the danger you may present to them, which is reflected in your premium expenses. If you're accepted, sign the documentation and pay your very first premium.

A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

You may want to upgrade your recipient info if you've had any significant life modifications, such as a marriage, birth or separation. Life insurance can occasionally really feel complicated.

No, level term life insurance does not have cash money worth. Some life insurance policies have an investment function that enables you to develop cash worth gradually. A portion of your costs payments is alloted and can make passion in time, which grows tax-deferred during the life of your insurance coverage.

These plans are commonly substantially more pricey than term coverage. If you reach the end of your plan and are still alive, the coverage finishes. You have some alternatives if you still desire some life insurance protection. You can: If you're 65 and your coverage has actually gone out, for instance, you might intend to acquire a new 10-year level term life insurance coverage plan.

Proven Decreasing Term Life Insurance

You may have the ability to convert your term protection into a whole life plan that will last for the rest of your life. Several types of degree term plans are exchangeable. That suggests, at the end of your insurance coverage, you can transform some or all of your policy to whole life protection.

Level term life insurance is a policy that lasts a collection term typically in between 10 and 30 years and features a level fatality advantage and degree premiums that remain the same for the whole time the plan is in result. This suggests you'll know specifically just how much your settlements are and when you'll have to make them, allowing you to spending plan accordingly.

Degree term can be a fantastic alternative if you're looking to get life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance coverage Barometer Study, 30% of all adults in the United state need life insurance and do not have any type of policy. Level term life is predictable and cost effective, which makes it one of one of the most preferred sorts of life insurance policy.

Latest Posts

Best Funeral Cover For Family

State Regulated Program For Final Expenses

Funeral Plan Seniors