All Categories

Featured

Table of Contents

There is no payout if the plan ends before your fatality or you live beyond the policy term. You might be able to renew a term policy at expiry, yet the costs will be recalculated based on your age at the time of revival.

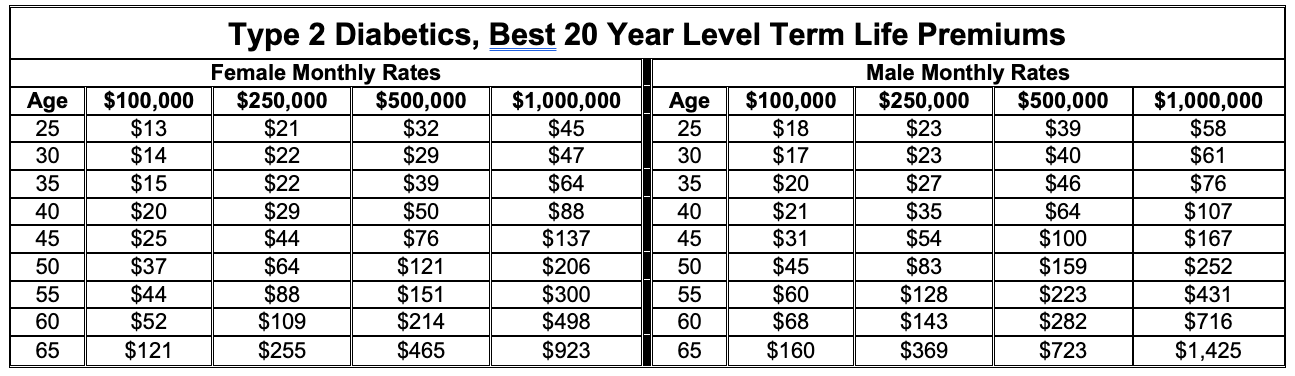

At age 50, the costs would certainly increase to $67 a month. Term Life Insurance Policy Rates thirty years old $18 $15 40 years of ages $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life policy, for males and females in excellent health and wellness. On the other hand, below's a consider prices for a $100,000 entire life policy (which is a sort of permanent policy, indicating it lasts your life time and consists of cash money worth).

Passion rates, the financials of the insurance company, and state policies can likewise influence costs. When you consider the amount of coverage you can obtain for your costs dollars, term life insurance coverage often tends to be the least pricey life insurance policy.

Thirty-year-old George wishes to shield his household in the unlikely event of his early fatality. He gets a 10-year, $500,000 term life insurance coverage plan with a costs of $50 per month. If George passes away within the 10-year term, the plan will certainly pay George's beneficiary $500,000. If he dies after the plan has ended, his recipient will receive no advantage.

If George is identified with an incurable disease throughout the first plan term, he possibly will not be eligible to renew the policy when it ends. Some policies provide guaranteed re-insurability (without evidence of insurability), but such attributes come at a greater price. There are numerous sorts of term life insurance policy.

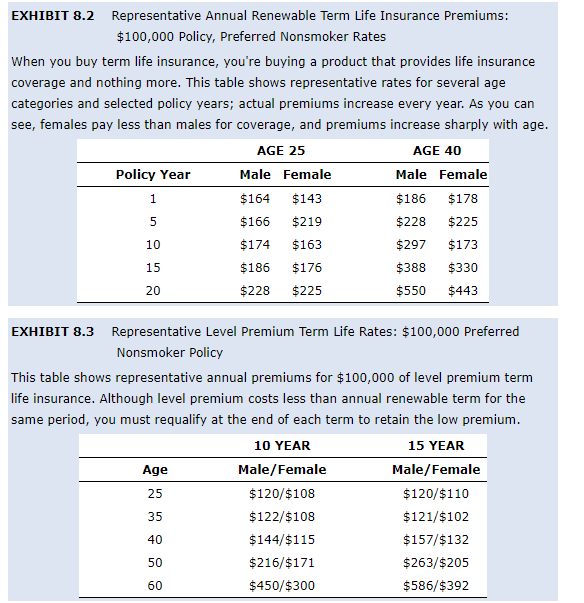

Usually, most business offer terms varying from 10 to three decades, although a couple of offer 35- and 40-year terms. Level-premium insurance has a fixed month-to-month payment for the life of the plan. Most term life insurance policy has a level costs, and it's the kind we've been describing in many of this write-up.

Long-Term Level Term Life Insurance Definition

Term life insurance policy is appealing to young individuals with kids. Moms and dads can acquire significant protection for an affordable, and if the insured passes away while the policy is in effect, the family members can rely on the death advantage to replace lost revenue. These policies are additionally appropriate for people with growing households.

Term life policies are ideal for people who want substantial insurance coverage at a low cost. Individuals that possess whole life insurance pay extra in premiums for less protection however have the protection of knowing they are shielded for life.

The conversion motorcyclist should allow you to transform to any kind of long-term plan the insurance policy business provides without limitations. The main functions of the biker are keeping the initial wellness rating of the term plan upon conversion (even if you later have health and wellness concerns or become uninsurable) and deciding when and exactly how much of the coverage to convert.

Of program, general premiums will certainly increase substantially given that whole life insurance policy is a lot more pricey than term life insurance coverage. Clinical conditions that establish during the term life period can not trigger costs to be raised.

Term life insurance coverage is a reasonably affordable method to supply a lump amount to your dependents if something happens to you. It can be a good option if you are young and healthy and balanced and support a family. Whole life insurance policy features substantially higher regular monthly costs. It is meant to give insurance coverage for as long as you live.

Expert Term Life Insurance For Couples

It depends on their age. Insurer established an optimum age limit for term life insurance policy plans. This is usually 80 to 90 years of ages yet may be higher or reduced depending on the firm. The premium also climbs with age, so a person aged 60 or 70 will pay significantly greater than someone years younger.

Term life is somewhat comparable to auto insurance policy. It's statistically not likely that you'll need it, and the costs are cash down the drainpipe if you don't. Yet if the most awful happens, your family will get the benefits.

The most popular type is now 20-year term. Most firms will certainly not sell term insurance coverage to an applicant for a term that finishes past his/her 80th birthday. If a policy is "eco-friendly," that implies it proceeds effective for an extra term or terms, approximately a defined age, even if the wellness of the guaranteed (or various other factors) would certainly trigger him or her to be turned down if she or he requested a new life insurance plan.

So, premiums for 5-year sustainable term can be degree for 5 years, after that to a new price reflecting the brand-new age of the insured, and more every five years. Some longer term policies will guarantee that the costs will not increase during the term; others don't make that guarantee, allowing the insurance provider to increase the rate throughout the plan's term.

This suggests that the policy's proprietor can transform it right into a permanent kind of life insurance coverage without added proof of insurability. In many kinds of term insurance policy, consisting of property owners and automobile insurance, if you have not had an insurance claim under the policy by the time it ends, you obtain no refund of the costs.

Comprehensive Guaranteed Issue Term Life Insurance

Some term life insurance policy consumers have actually been miserable at this outcome, so some insurance providers have developed term life with a "return of costs" function. does term life insurance cover accidental death. The costs for the insurance with this feature are frequently significantly more than for policies without it, and they usually call for that you keep the plan in pressure to its term otherwise you waive the return of premium advantage

Level term life insurance coverage premiums and death advantages stay consistent throughout the plan term. Degree term life insurance policy is commonly a lot more economical as it doesn't develop cash worth.

Guaranteed Direct Term Life Insurance Meaning

While the names usually are made use of reciprocally, degree term protection has some essential differences: the premium and survivor benefit stay the exact same throughout of insurance coverage. Degree term is a life insurance coverage plan where the life insurance policy costs and fatality advantage stay the very same throughout of coverage.

Latest Posts

Best Funeral Cover For Family

State Regulated Program For Final Expenses

Funeral Plan Seniors