All Categories

Featured

Table of Contents

- – How Does 20-year Level Term Life Insurance Pol...

- – Is Level Premium Term Life Insurance the Right...

- – What is Increasing Term Life Insurance Covera...

- – What is Joint Term Life Insurance? How It Hel...

- – The Benefits of Choosing 10-year Level Term ...

- – What is Guaranteed Level Term Life Insurance...

If George is detected with a terminal health problem during the very first plan term, he most likely will not be eligible to renew the plan when it ends. Some policies supply guaranteed re-insurability (without proof of insurability), however such attributes come with a greater expense. There are several kinds of term life insurance policy.

A lot of term life insurance coverage has a level costs, and it's the kind we have actually been referring to in most of this post.

Term life insurance is appealing to young people with kids. Parents can obtain significant coverage for a low cost, and if the insured dies while the policy is in effect, the family members can count on the fatality benefit to change lost earnings. These plans are also fit for people with expanding households.

How Does 20-year Level Term Life Insurance Policy Work?

Term life policies are perfect for people that want significant insurance coverage at a reduced price. Individuals who possess entire life insurance policy pay extra in premiums for less coverage but have the security of understanding they are safeguarded for life.

The conversion rider need to allow you to convert to any irreversible plan the insurance provider uses without limitations. The key features of the biker are keeping the original health and wellness score of the term plan upon conversion (also if you later on have health and wellness problems or end up being uninsurable) and determining when and just how much of the protection to transform.

Of training course, overall costs will certainly enhance dramatically since whole life insurance coverage is a lot more pricey than term life insurance. Clinical conditions that create during the term life duration can not create premiums to be increased.

Is Level Premium Term Life Insurance the Right Fit for You?

Term life insurance is a relatively economical way to give a round figure to your dependents if something occurs to you. It can be an excellent alternative if you are young and healthy and balanced and sustain a household. Whole life insurance policy includes substantially higher monthly premiums. It is indicated to offer protection for as long as you live.

It depends on their age. Insurer established a maximum age limit for term life insurance plans. This is usually 80 to 90 years of ages but might be greater or lower depending upon the firm. The costs likewise climbs with age, so a person matured 60 or 70 will pay substantially greater than somebody years more youthful.

Term life is rather comparable to cars and truck insurance policy. It's statistically not likely that you'll need it, and the costs are money down the drainpipe if you do not. However if the worst takes place, your family members will get the benefits (What is level term life insurance).

What is Increasing Term Life Insurance Coverage Like?

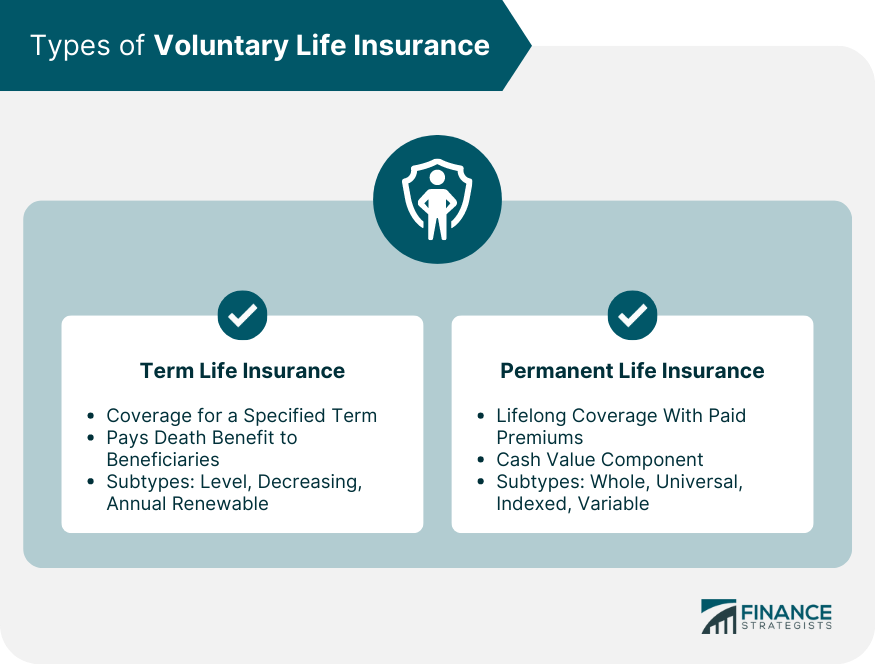

For the a lot of component, there are two sorts of life insurance policy strategies - either term or long-term strategies or some combination of both. Life insurers use numerous types of term strategies and traditional life policies in addition to "passion delicate" products which have actually become a lot more prevalent because the 1980's.

Term insurance coverage offers defense for a specific amount of time. This period might be as brief as one year or give coverage for a specific variety of years such as 5, 10, twenty years or to a defined age such as 80 or in some situations as much as the oldest age in the life insurance policy mortality tables.

What is Joint Term Life Insurance? How It Helps You Plan?

Presently term insurance prices are really affordable and among the cheapest traditionally experienced. It should be kept in mind that it is a widely held belief that term insurance coverage is the least costly pure life insurance policy coverage offered. One requires to review the plan terms meticulously to decide which term life choices are suitable to meet your certain circumstances.

With each brand-new term the costs is enhanced. The right to renew the plan without proof of insurability is a vital advantage to you. Otherwise, the danger you take is that your health might deteriorate and you might be unable to obtain a policy at the very same rates or even whatsoever, leaving you and your beneficiaries without insurance coverage.

You have to exercise this alternative throughout the conversion duration. The length of the conversion period will vary depending on the kind of term plan purchased. If you convert within the recommended period, you are not called for to offer any kind of info about your health and wellness. The costs rate you pay on conversion is normally based on your "current obtained age", which is your age on the conversion day.

Under a degree term plan the face quantity of the policy stays the very same for the whole duration. With reducing term the face quantity reduces over the duration. The premium stays the very same each year. Frequently such policies are offered as mortgage protection with the quantity of insurance decreasing as the equilibrium of the home mortgage lowers.

Typically, insurance companies have actually not can transform costs after the plan is marketed. Because such plans may continue for several years, insurance firms must use traditional death, interest and cost price estimates in the costs calculation. Flexible costs insurance coverage, however, allows insurance firms to offer insurance policy at reduced "existing" costs based upon much less conservative assumptions with the right to change these costs in the future.

The Benefits of Choosing 10-year Level Term Life Insurance

While term insurance policy is designed to supply security for a defined period, permanent insurance coverage is developed to give coverage for your entire lifetime. To keep the costs rate level, the costs at the more youthful ages goes beyond the real price of protection. This added premium develops a book (money value) which aids pay for the policy in later years as the expense of protection increases above the costs.

Under some plans, costs are needed to be spent for a set variety of years (What is a level term life insurance policy). Under various other plans, costs are paid throughout the insurance holder's life time. The insurance provider invests the excess premium bucks This sort of plan, which is in some cases called cash value life insurance policy, creates a financial savings aspect. Cash money values are essential to a permanent life insurance policy policy.

In some cases, there is no correlation between the dimension of the money value and the costs paid. It is the money value of the policy that can be accessed while the policyholder lives. The Commissioners 1980 Standard Ordinary Mortality (CSO) is the existing table utilized in computing minimum nonforfeiture worths and policy gets for ordinary life insurance policies.

What is Guaranteed Level Term Life Insurance? A Simple Breakdown

Lots of permanent plans will certainly include stipulations, which define these tax obligation requirements. There are two basic classifications of irreversible insurance policy, traditional and interest-sensitive, each with a number of variations. Additionally, each category is generally available in either fixed-dollar or variable type. Typical whole life plans are based upon long-term quotes of cost, passion and death.

Table of Contents

- – How Does 20-year Level Term Life Insurance Pol...

- – Is Level Premium Term Life Insurance the Right...

- – What is Increasing Term Life Insurance Covera...

- – What is Joint Term Life Insurance? How It Hel...

- – The Benefits of Choosing 10-year Level Term ...

- – What is Guaranteed Level Term Life Insurance...

Latest Posts

Best Funeral Cover For Family

State Regulated Program For Final Expenses

Funeral Plan Seniors

More

Latest Posts

Best Funeral Cover For Family

State Regulated Program For Final Expenses

Funeral Plan Seniors